How to Get Approved for a Loan Fast

You can use personal loans for many purposes, including debt consolidation, home improvement and covering unexpected expenses. However, interest rates and loan terms vary by lender, so it’s important to understand your options to select the right one for your needs and budget.

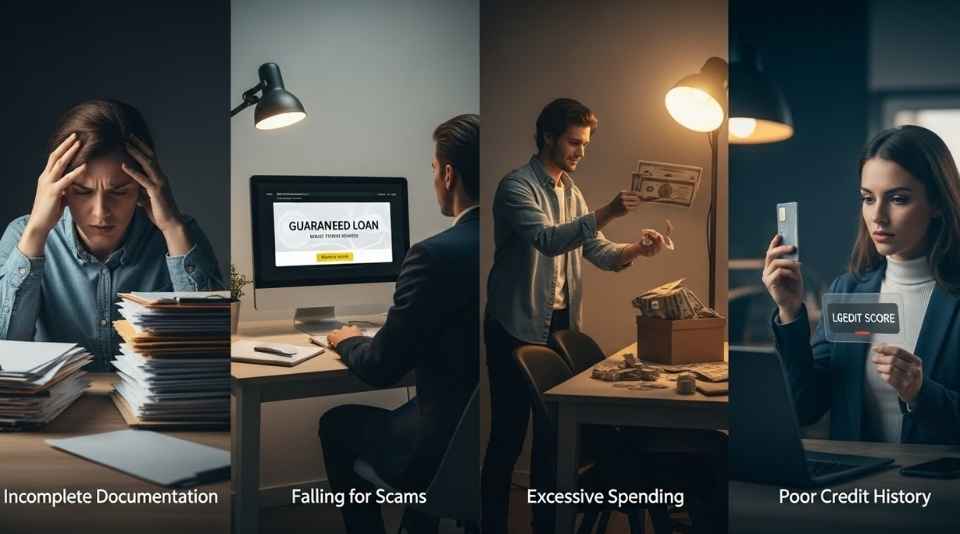

It’s also a good idea to compare lenders’ credit requirements to find out which ones are most likely to approve you for a personal loan. Most lenders prefer applicants to have a high-to-excellent credit score, but some work with borrowers with fair or average scores as well. Some require additional documentation such as pay stubs or bank account information to verify income.

If you have a poor credit history, getting approved for a personal loan can be difficult and may come with higher interest rates and fees. But you can improve your chances of being approved for a personal loan by paying off any outstanding debt, improving your credit score and making on-time payments on existing debt.

A personal loan is a lump sum of money that you repay in installments, plus interest, over a set term. Most personal loans are unsecured, meaning you don’t have to put up any collateral as security. However, you typically have to pay a higher monthly payment than you would with a credit card.